Hacking Your Money Mindset

We often listen to talks, watch videos and read articles about emotional intelligence. However, there is another type of intelligence that is equally important but often overlooked – financial intelligence.

Whether you are a student, a professional, or a business owner, having a positive “money mindset” and being financially intelligent is crucial for a healthy financial future. Why? No, I am not going to tell you that you will be a millionaire if you are financially intelligent and have the right mindset. Rather, it will help you achieve your financial goals, grow existing wealth, reduce stress and avoid costly mistakes.

Unfortunately, growing up in Bangladesh, neither my teachers nor my family taught me how to effectively manage money, and to this day, there is little to no coverage of financial literacy in the academic curriculum. As a result, when we grow up and start earning money, we struggle to maintain a healthy spending and saving plan for ourselves.

Money mindset

Now, what is the money mindset? It is simply the set of beliefs and attitudes you hold about money, which influences the choices you make regarding how you save, spend, and manage your finances.

Consider a scenario. You enter into a supershop to only buy a specific quantity of good A and end up checking out at the counter with goods A, B, C, D and who knows what else. This happens to many of us. So you see how our habits, thoughts and behavior largely influence our spending and saving decisions. And that is why we are calling it the ‘money mindset’.

How to know if you have a positive money mindset

To assess if you have a positive money mindset, simply ask yourself the following questions:

- Can I resist unnecessary spending, even though I have the freedom to spend?

- Do I enjoy providing financial assistance to those in need?

- Can I avoid comparing my financial condition to others’?

- Do I think I can achieve my financial goals?

If your answer to each of these questions is ‘yes’, then you can consider yourself a person with a healthy money mindset.

Developing a money mindset

However, you can always develop a positive money mindset and shift your money mindset by actively practicing certain behaviors. I will tell you about some of the small changes you can make in your behavior that can help you cultivate a positive money mindset.

Track your spending

If you have any takeaway from this article, I want it to be this: track your spending. I can’t tell you enough how important it is to keep track of your spending. If you are not aware of where your money goes each month, then how would you know if you’re overspending or if you could save more?

Tracking your spending doesn’t require you to appoint a team of accountants. All you need is a few minutes each day to log your expenses using a budgeting app or a spreadsheet. Once you start keeping track of your spending, you’ll be able to identify areas where you could cut back, prioritize your spending, and stay on track toward your financial goals.

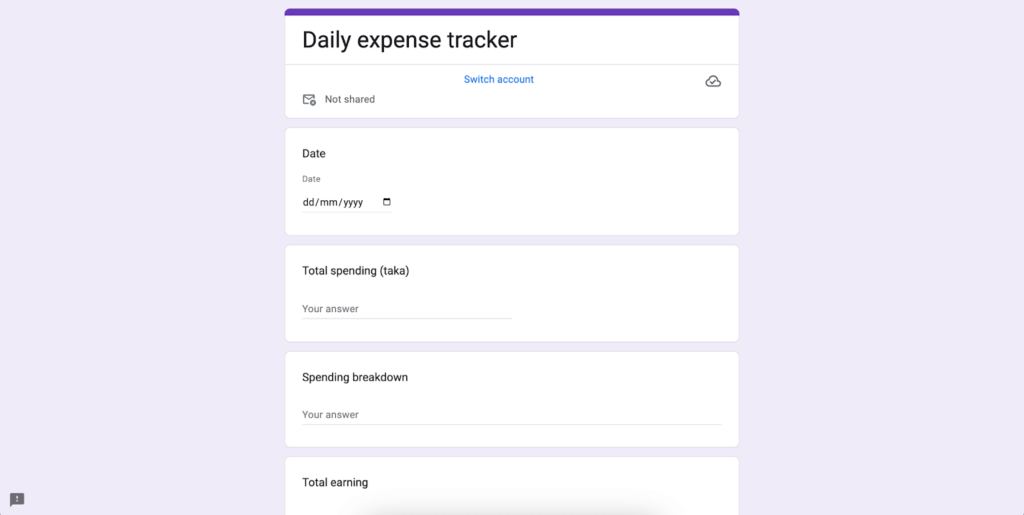

Here’s how I do it for myself: I’ve created a form using Google Forms where I can input my daily expenditures and earnings.

The form entries are saved in a Google Sheet where I can see the summary of my monthly expenditure and earnings. This helps me stay updated on my current account balance and resist overspending.

Save before you spend

Recall the traditional formula for calculating savings. It is your income minus your consumption that is equal to your savings. Just make a small change in this formula by changing the sides of consumption and savings.

By doing this, you’ll ensure that you always set aside a portion of your income as your savings. This simple shift in mindset and behavior can have a significant impact on your financial well-being over time.

Scarcity mindset to abundance mindset

Do you live paycheque-to-paycheque? Do you always worry about money? Do you feel upset with your current financial situation? If your answers are ‘yes’, chances are that you are having a scarcity mindset.

A scarcity mindset is when you think there isn’t enough of something for everyone, which makes you feel like you never have enough of it yourself. This type of mindset doesn’t let you be happy and leads to anxiety. It makes you feel that you are facing impossible challenges that have no way out.

On the other hand, an abundance mindset is when you feel secure and good about yourself, and you believe you have enough. Instead of worrying about what you lack, you focus on appreciating what you already have.

To overcome a scarcity mindset, you can follow the steps mentioned below:

- Instead of thinking about how further you need to go, focus on how much progress you have already made.

- Try to worry less and appreciate more. Cultivating a sense of gratitude can increase your happiness and your overall satisfaction with life.

- Hang out with people who have an abundance mindset.

- Believe in your self-worth.

Procrastinate when it comes to spending

You may have been surprised seeing the word ‘procrastinate’ in the heading. Procrastination is generally thought of as a negative habit, but when it comes to spending, it can actually be a good thing.

We often make impulsive purchases that can lead to financial stress and regret, so it’s important to pause and think before making a purchase.

Instead of immediately hitting the ‘Add to Cart’ button, try procrastinating for a little bit, maybe a few days. Ask yourself if you really need the item. Trust me, by doing this, you can avoid unnecessary purchases and save a hefty amount of money in the long run.

Seek investment opportunities

Investment doesn’t always have to be wealthy people’s thing. If you have taken care of your necessary expenses and set aside enough for emergency situations, consider investing whatever extra amount you have. Leaving your money sitting idly in a bank account may not be the wisest option in terms of potential returns, but investment is.

By seeking out investment opportunities, you can grow your wealth. You can start by researching different investment options available to you. Don’t let a small amount of money hold you back from exploring investment options that could help you grow your wealth.

Wrapping up

Some small changes here and there can make a big difference over time. Remember, financial intelligence or money mindset is not about becoming a millionaire, but about maintaining a healthy financial life.